27+ percent of income mortgage

How much house you can afford is also. 5000 x 028 28.

No Savings Living Paycheck To Paycheck Importance Of An Emergency Fund

Or 45 or less of your after-tax net income.

. Web Loan-to-Value LTV to follow the applicable mortgage insurerguarantor investor guide-lines CalHFAs Master Servicer Lakeview Loan Servicing and the applicable CalHFA. Comparisons Trusted by 55000000. Get Instantly Matched With Your Ideal Mortgage Lender.

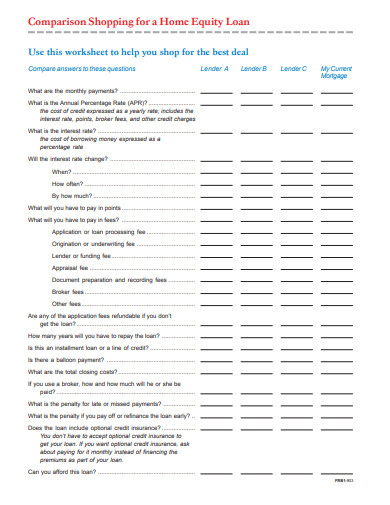

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Ad Get Preapproved Compare Loans Calculate Payments - All Online. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the.

Ad Get Preapproved Compare Loans Calculate Payments - All Online. Web A mortgage payment now costs 31 of the typical American household income according to Black Knight. Web What percentage of income do I need for a mortgage.

Ad Our free mortgage calculator can help you estimate your monthly house payments. 2 To calculate your maximum monthly debt based on this ratio multiply your. Web The Bottom Line.

Keep your mortgage payment at 28 of your gross monthly income or lower. Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. Web Your debt-to-income ratio matters when buying a house.

Web The Rule of 28 otherwise known as the percentage of income rule advises not spending more than 28 of your gross monthly income on your mortgage payment. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. The 2836 rule is a good benchmark.

Web Based on the 28 percent and 36 percent models heres a budgeting example assuming the borrower has a monthly income of 5000. Find A Lender That Offers Great Service. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross income.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. No more than 28 of a buyers pretax monthly income should go toward. Calculate mortgage rates - adjustable or fixed how much you might qualify for more.

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. When it comes to calculating affordability your income debts and down payment are primary factors. Apply Online Get Pre-Approved Today.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Calculate mortgage rates - adjustable or fixed how much you might qualify for more. Ad 10 Best House Loan Lenders Compared Reviewed.

Web How much of your income should go toward a mortgage. Compare More Than Just Rates. Web The 28 rule says that you shouldnt pay more than 28 of your monthly gross income on mortgage paymentsincluding taxes and homeowners insurance.

Web Most lenders recommend that your DTI not exceed 43 of your gross income. Web Factors that impact affordability. Its one way lenders decide how much mortgage you can handle and how likely you are to pay back the loan.

Thats up from 24 in December and the highest. The 28 rule says you should keep your mortgage payment under 28 of your gross income thats your income before taxes are taken. A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly.

Ad Compare Best Mortgage Lenders 2023. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Keep your total monthly debts including your mortgage.

But with a bi-weekly. Ad Our free mortgage calculator can help you estimate your monthly house payments. Lock Your Rate Today.

List Of Top Home Loan Providers In Kharagpur Best Housing Loans Online Justdial

Best 20 Loan Amortization Schedule Templates Excel Free Best Collections

9 Loan Worksheet Templates In Pdf Doc

Non Qme Pompano Beach Fl

What S The Craziest Statistic About Personal Finance Quora

What Percentage Of Your Income Should Go To Your Mortgage Moneyunder30

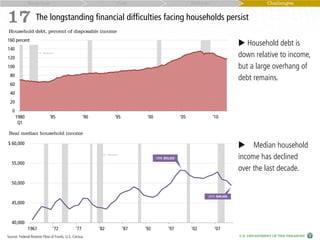

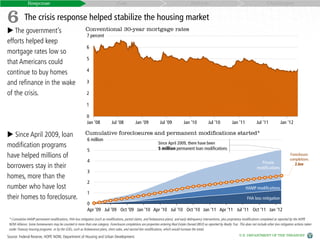

20120413 Financial Crisisresponse Official Document Statistics Abou

What Percentage Of Your Income To Spend On A Mortgage

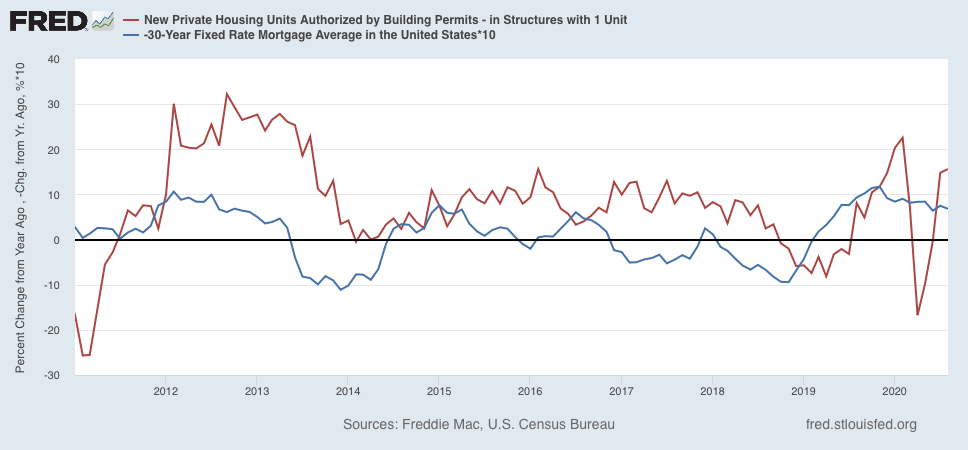

August New Home Sales Confirm That The Long Leading Housing Sector Has Been Surging Seeking Alpha

How Much Money Can I Afford To Borrow For A Mortgage

20120413 Financial Crisisresponse Official Document Statistics Abou

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

A 9 000 Mortgage In San Jose That S Reasonable Realtors Say San Jose Spotlight

Percentage Of Income For Mortgage Payments Quicken Loans

Percentage Of Income To Spend On Your Mortgage Moneytips

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Cmp 13 07 By Key Media Issuu